By Gladys Kole

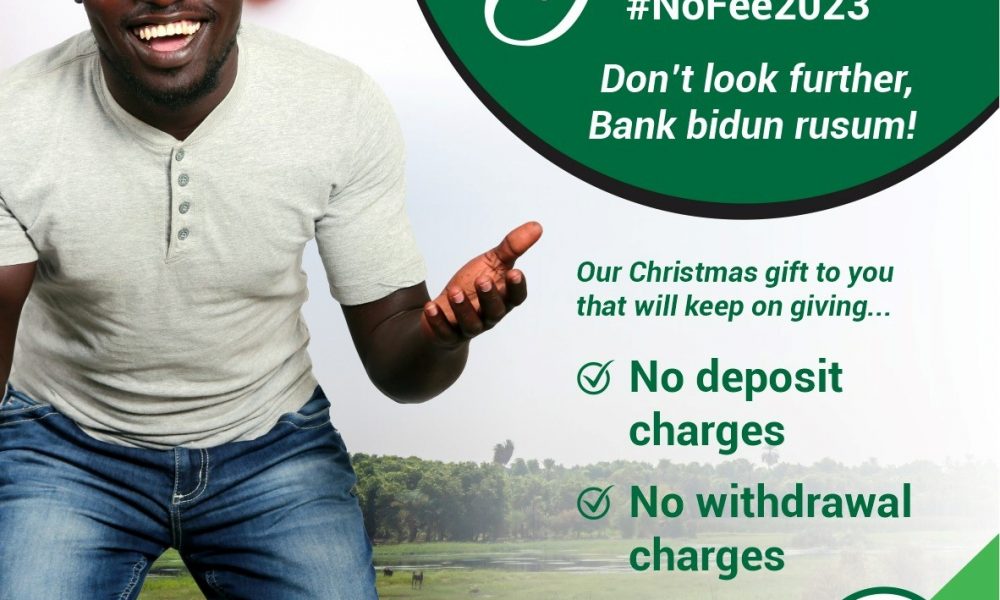

Kush Bank South Sudan, a national financial entity has yesterday made historical announcement as the first and only bank to break down the barriers to financial inclusion by introducing fee-free deposits and withdrawals across all its branches.

The new promotional service will come into effect as of November 25th 2022. Individual and SME customers will be depositing and withdrawing their money in any currency without being charged any fees at the bank.

“We live and work in a country where operating a bank is very expensive; this is a fact of offering services in the newest nation on earth, where infrastructure is still developing” said the Acting CEO of Kush bank Mr. Ryan O’Grady.

“As a national bank in South Sudan, where the rate of financial inclusion is amongst the lowest on earth, we have an obligation to break down barriers to financial inclusion, to support the development of a sustainable SME sector, and to help our country diversify and develop a strong, ethical, and transparent financial sector” he continued.

In September, at the national oil and power conference, the CEO said “I spoke about the need to break down barriers for women and youth-led businesses in our country, and today’s step is another one down this important path we are on together”.

Ryan said they they’ve spent the last six months developing this solution.

“At Kush Bank, we aren’t talking about solutions; we are walking the walk and implementing them rapidly to respond to the needs of our country. We invite the people of South Sudan to join us in strengthening our economy and building a safe and transparent financial system together” he said.

Earlier this year, Kush Bank embraced a digital footprint, launching a mobile app and Internet Banking, and the bank further strengthened its footing by announcing a major branch expansion in key markets, the bolstering of services through a capital raising division, and an investment and advisory team based in Dubai.

Established in 2012, Kush Bank is licensed by the Bank of South Sudan as a national financial institution, offering retail and commercial banking products across the country from 6 branches, with another 4 branches in development in 2022/ 2023.

The Bank offers a full suite of banking products, including individual, commercial, humanitarian, investment services, and advisory products.