Cooperative are defined as “an autonomous association of persons united voluntarily to meet their common economic, social and cultural needs and aspirations through a jointly owned and democratically controlled enterprise” they are instruments of economic growth and equitable distribution of resources for the improvement of livelihood of all, particularly the majority of the rural populations.”

Cooperatives are pathway out of poverty, their unique model provides comparative advantage for balanced inclusion of women, youth and other vulnerable group into the economic production of the Country

Types of Cooperatives societies:

- Producers Cooperatives Society

- Consumer Cooperatives society

- Marketing Cooperatives Society

- Manufacturing Cooperatives Society and

- Credit /Financial Cooperative Society

In this article, I would like to share with the public about a financial Cooperative Society, that is the Saving and Credit Cooperative Society (SACCO)

DEFINITION OF SACCO

SACCO is an abbreviation for Savings and Credit Cooperative Society; it is a financial cooperative society established voluntarily by its members based on the philosophy of building self-help projects or businesses.

HISTORY OF SACCO’s

The history of SACCO Societies or Credit Unions shows that they were formed for the relief of poverty among the poorer economic classes in Europe. They were invented in South Germany in 1846 at the time of agricultural crises and continues drought in Europe by two community business leaders Frederich W. Raiffeisen and Herman Schultze.

SACCO’s industry plays a very important role as a financial intermediary between savers and investors. They have been developed to meet the fundamental human need to find a way of saving and borrowing methods without taking risks and without handing over too much power to money landers. Globally, the sector has 1 billion members. It is estimated that cooperatives have employed 250 million people all over the world; Cooperatives have an estimated global turnover of 2.2 trillion US dollars. Cooperatives generate 2.2 trillion US dollars in turnover while providing infrastructure and services that the society need to flourish.

In Africa Kenya is number one (1) and number seven (7) in the world with 30% annual GDP Generally in Africa the growth of SACCO’s has been experienced to the extent that in 1965, Africa Federation of Cooperative Societies Saving & Credit (ACCOSSCA) was formed with the principal objective of offering SACCO’s insurance, education to members and promoting cooperatives principles. Africa has membership of 16 million which is 8 percent of the whole world membership, with saving of 62% and loans of 65 % being 3rd after Asia and North America. Africa mobilize 0.4 % of the world-wide savings of US$ 1.1 trillion and 0.4 US $ international loans given to members standing at US$ 912 billion.

PURPOSE OF SACCO

SACCO’s play a very important role to their members by offering them affordable financial credit and investment advisory services that help in improving their economic well-being and consequently the economic growth of the country at large.

According to Qin & Ndiege (2013) SACCOs have helped solve the problem of capital inadequacy for customers who were not assisted by commercial banks and other formal financial institutions by offering small amount of loans without legally demanding for the valuation of their collateral. This means that the sustenance of SACCOs widens the financial inclusion “net “to include the excluded, those regarded as poor or less fortunate in the society.

In the absence of SACCOs, the poor will have no choice but to approach the unregulated money lenders who provides services that are fast and flexible, but charge interest rates ranging from 60-100% and who may enforce repayment by illegal and exploitive means.

SACCOs therefore, enable poor people to have their voices heard in addition to improving their daily working and living conditions. SACCOs are an ideal instrument to empower the poor in sustainable way.

SACCOs enable farmers to create economies of scale in bargaining with urban banks and other financial institutions, they provide access to sustainable financial services, and provide low-income families with safe place to Save Their Income at their areas with reasonable priced loans.

EXAMPLE OF CATEGORIES OR GROUPS OF INSTITUTIONS WHO CAN FORM A SACCO IN THE CONTEXT OF SOUTH SUDAN

- Members of the Executives

- Members of the parliament

- Business Owners

- Community Associations

- Teachers’ associations

- Health Workers

- Drivers’ / Boda bodas

- Employee in any sector

- Church members

- Organize forces

- Mosque members

- Lawyers

- Women of common interest

- Youth of common interest

- People with special needs

- Sanduk Sanduk Groups

- Rabita Groups

- And many more others.

Therefore, the purpose of this article is to advice our citizens to embrace formation of SACCOs as financial intermediaries to improve livelihoods, reduce dependency and promote faster economic growth.

HOW TO FORM A SACCO IN CENTRAL EQUATORIA STATE

Requirements

- Present a proposed name including area of operation and objective of the SACCCO to the registrar of Cooperatives, at the Ministry of Cooperatives and Rural Development (MC&RD), Central Equatoria State

- Collect Application Form No CS Form no 1 from the Registrar of Cooperatives,

- Present Minutes of the first two meetings to the Registrar of Cooperatives together with:

- Four Copies of By-laws (get more importations from the Registrar about By-Laws)

- List of leadership /Governance

Registration fee of 50.000 SSP

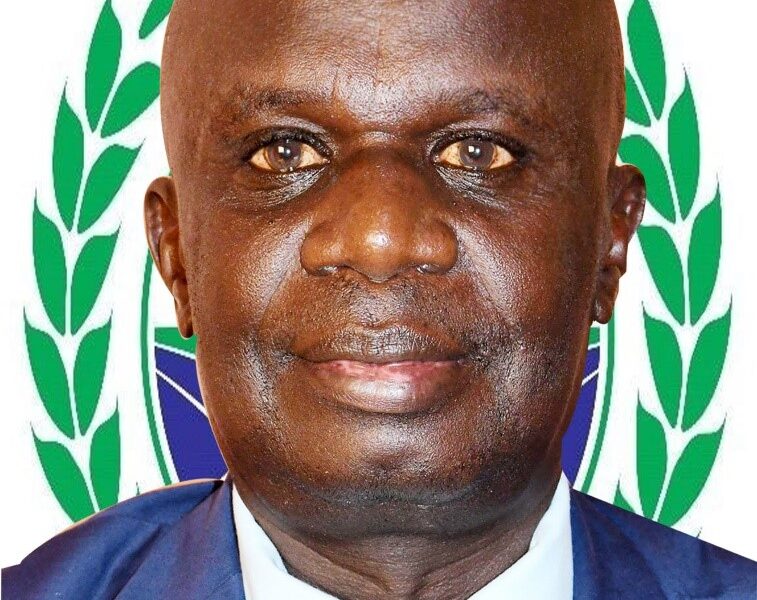

Hon. Peter Lujo Yosepata is Minister of Cooperatives and Rural Development, Central Equatoria State & Co Founder Eden Commercial Bank Plc.

For more information visit the state ministry of Cooperatives & Rural Development

Central Equatoria State –Juba

Tel; 0925599222/0915599222

What App 0926018777 email lujopeter21@gmail.com