By Philip Buda Ladu

Bank of South Sudan (BOSS) has announced launching the country’s first National Instant Payment System (NIPS).

The project, in collaboration with AfricaNenda Foundation Company, is a significant step towards modernizing the nation’s financial infrastructure.

In a press statement, Central Bank emphasized that NIPS will enable real-time, secure, and affordable transactions, connecting banks, mobile money providers, and other financial institutions.

Furthermore, it will support various payment types, including person-to-person (P2P), person-to-business (P2B), government-to-person (G2P), and person-to-government (P2G) transactions.

According to the central bank, this initiative aims to boost financial inclusion and efficiency across the financial sector.

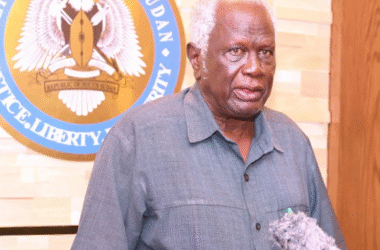

“This is a monumental step forward for financial and socioeconomic inclusion in South Sudan,” bank governor Johny Ohisa stated.

“This partnership with AfricaNenda Foundation is pivotal in transforming the financial services landscape, fostering greater inclusivity, and creating a more resilient digital economy,” he added.

The collaboration will focus on developing a detailed implementation roadmap, building capacity within BOSS and financial institutions, and ensuring integration and interoperability with banks, telecommunication companies, and other stakeholders.

Following a successful proof-of-concept phase in 2023, BoSS and AfricaNenda are optimistic that NIPS will significantly reshape South Sudan’s financial ecosystem.

The system is expected to improve financial accessibility, empower businesses, streamline government operations, and enable citizens to participate more fully in a modern digital economy.

The launch of NIPS aligns with broader efforts to implement other critical infrastructures, such as Automated Clearing House (ACH) and Real Time Gross Settlement (RTGS) systems.

Meanwhile, the Bank of South Sudan emphasized its commitment to building a sustainable, innovative, and inclusive financial future for all South Sudanese citizens.

“Instant payment systems are transformative tools that redefine access to financial services and promote inclusivity,” Governor Ohisa added. “With the launch of this system, South Sudan is laying the foundation for a more connected and resilient economy that benefits every citizen.”