By Bida Elly David

The governor of Central Bank has warned and advised the public against accepting online money businesses operated by illegal companies through the use of digital software such as Bitcoin among others.

This development came following numerous online businesses created by unrecognized and unregulated online companies that use people to register and enjoy money through digital platforms.

Virtual currency or virtual money is a digital currency that is largely unregulated and issued as well as controlled by its developers, used and accepted electronically among members of a specific virtual community.

In South Sudan, varieties of such online companies have been in existence without the notice of the government’s financial institutions responsible to regulate their activities. Most of their registration platforms are found online without specific offices in the Country.

Their marketing team uses the social media such as the messenger, Whatsapp and Instagram to target their customers. According to their business transaction, the number of customers you bring into the business would determine the amount of money you would earn.

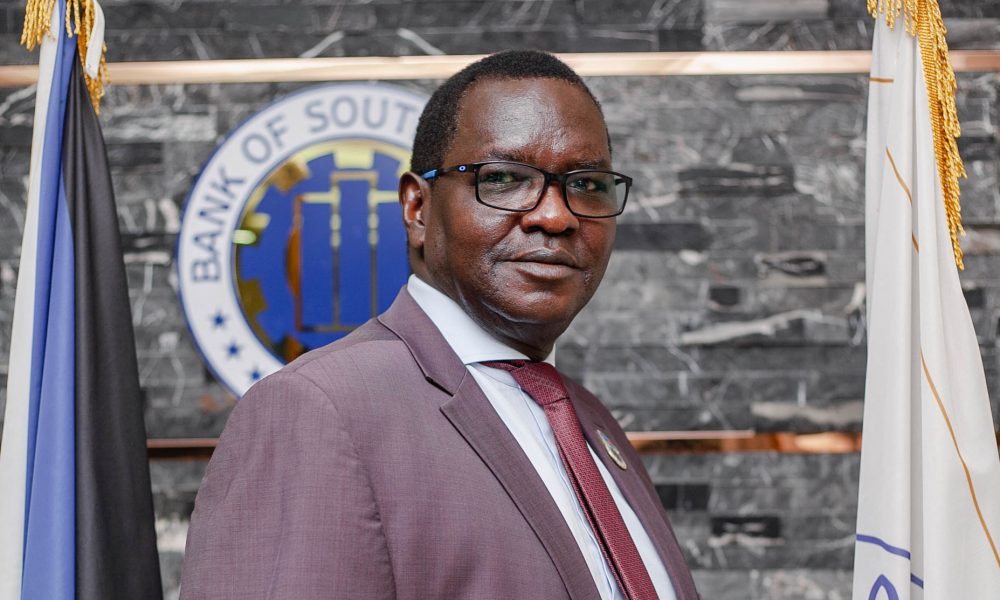

In a statement seen by No.1.Citizen Daily Newspaper yesterday, the governor of Central Bank advised the public to be cautious while joining such business since they operate out of government regulations.

“The Bank of South Sudan (BOSS) wishes to advice members of the public who are investing in or otherwise conducting transactions in virtual currencies of the potential risks associated with buying, holding or trading in virtual currencies. While it is recognized that investing in virtual currencies can promise a high return and other benefits such as lower transaction costs and processing times, the bank of South Sudan wishes to advise members be cautious,” he jagged

He said that virtual currencies such as Bitcoin digital representation used as online money trading did not have any legal tender status in South Sudan thus could be risky for the public to involve in such business.

“Virtual currencies such as Bitcoin are a digital representation of the value that can be digitally traded and functions as a medium of exchange within a specified online community but do not have legal tender status in South Sudan. Providers of virtual currencies in South Sudan are neither regulated nor supervised by the Bank of South Sudan and there is currently no legislative provision under the bank’s purview that provides protection to customers for losses arising from the virtual currencies,” he said.

In addition, he said that unregulated virtual currencies companies may lack appropriate internal controls and may be more susceptible to fraud and theft than the regulated financial institutions.

“Transactions involving virtual currencies are subjected to a high degree of anonymity. As such, there is a potential misuse of virtual currency to conduct criminal activity including money laundering or terrorism financing. Virtual currencies tend to be volatile and their value can fluctuate significantly. The volatility of virtual currencies makes them unsuitable for most investors especially those investing for long-term goals,” he said.

Finally, he said that Central bank noted with concern social media reports on the emergency of schemes purported to be virtual currencies that promised high returns when members purchase and recruit others to join or invest.

“We strongly advise members of the public to be cautious of such schemes and conduct appropriate due diligence as these may be Ponzi schemes in disguise,” he said.