By Aweye Teddy Onam

The Mayor of Juba City Council Michael Lado Allah-Jabu on Wednesday hinted that the coffers of the City Council are running low of daily revenues influx, as such, they are introducing “town rate taxes” for the residents of Juba without exemption.

Citing lack of funding from the national government, and reluctance by the citizens to pay taxes as the reasons for the introduction of the taxes plan; Mayor Allah-Jabu said the household taxes will bolster the City Council’s capacity to deliver services to the citizens.

“Town rate taxes (household taxes) are for all residents of Juba. The taxes are for service delivery in the city. The town rate is part of the rent for the land that people are staying in and the city council will produce a demand note soon,” Mayor Allah-Jabu was quoted as saying by the media.

The taxes which will also fish both commercial property, and landowners “door-to-door” in order to swell the City Council’s treasury have been casted with a grain of salt by policy analyst, activist, trader, and the ordinary citizen.

The Director for the Institute of Social Policy and Research, James Boboya Edmond said there are some illegal taxation exercises being undertaken by the City Council, saying how possible the new taxes be implemented.

“There are a lot of taxes, others are even illegal taxes that are in the making so the City Council has failed to collect taxes in accordance with the law so how are they going to even implement another law, that is going to create a lot of problems in the city,” he told No.1 Citizen Daily newspaper in an interview.

“There is no clean water, clean town, no pavement of roads, electricity, so the priority of the government of Central Equatoria and the city council should be how they can bring clean water to Juba. There are priorities that the government needs to put in place other than talk about taxes,” he added.

The City Council Mayor has however, not mentioned when the new tax policy will be enforced on the residents of Juba.

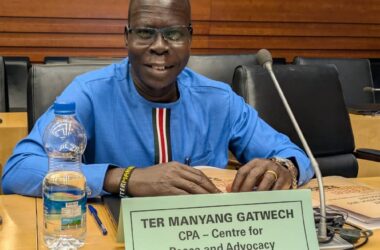

But Edmund Yakani, the Executive Director for Community Empowerment for Progress Organization (CEPO), said there is need for the citizens to be informed about the reasons for the taxes as well as their economic power should be examined to determine their ability to pay the taxes.

“Juba City Council need to carry out orientation for citizens to understand the purpose of the tax and how the tax are going to be collected and what purpose are the tax being collected because under what circumstances you may begin to collect door to door [taxes] and the variation in the standard of living, some people may not have income to pay the tax”.

According to the Mayor, there will be transparency in the collection of the town taxes, however, city traders, and vendors have been voicing their concerns that city council levy heavy taxation with the threats to close their shops if one fails to succumb to their taxes demand.

“It is going to be diplomatic for the Juba City Council to collect the tax, so it should not be by force but should be in a negotiating manner between the taxpayer and the Juba City Council,” Edmund stressed.

Wilson Akol Mawut, Managing Director at Akoldit Transport Company Limited said there are no results of the taxes that have been paid saying there is no sense in paying taxes.

“I also pay tax for my businesses and these taxes up to today I don’t know where the tax is going like nothing has been done so far, my business is suffering and the only feedback I get is intimidation if I don’t pay on time,” Akol decried.

He added “I can’t see any reason for paying tax. Let me say the government is coming to my door to ask for money, how can [I] be paying the government and they are not collecting garbage and come to my business premises to interrogate [me] to pay fines”.

Lino Ater, a resident in Juba’s Gudele neighborhood said Juba City Council should reconsider their decision on the introduction of the household taxes because imposing additional tax without the evidence of the previously paid tax is not right.

“If we have to pay more tax they should tell us how they have generated the money all these years yet the city is still looking very bad even in some countries will be regarded as their rural city because of the set up,” Ater raged.

Besides, landowner and a businessman in Munuki who preferred to be anonymous said yearly there is something called term rate as it is in the rent list, whereby some rentals pay yearly. And the taxes are collected depending on the classes and some people are not paying because the payments have gone high. That’s the reason as to why the government has decided to start door to door collection.