By Philip Buda Ladu

Members of the Transitional National Legislative Assembly (TNLA) have raised serious concerns regarding the country’s escalating debt crisis, calling on the government to take immediate action.

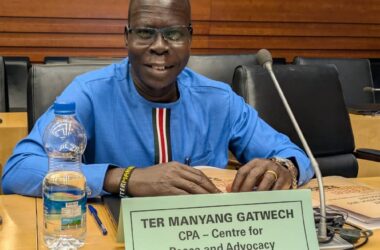

The concerns were echoed during Tuesday’s parliamentary session in which the Specialized Committee for Public Accounts presented a detailed report on the participation of South Sudan’s delegation that attended a workshop on the Transitional States Forum (TSF) in Addis Ababa, Ethiopia in June.

It focused on strengthening the capacity of transitional states to manage and mitigate debt distress.

The report revealed a number of critical shortcomings in South Sudan’s current approach. Key among the recommendations tailored by the committee included the establishment of a dedicated Loan Management office and Debt Management Department within the Ministry of Finance and Planning.

Lawmakers emphasized the importance of these institutions in ensuring that loans are borrowed responsibly, managed effectively, and accounted for transparently.

They warned that failure to do so could lead to a debt crisis that would have severe consequences for the country’s economic development.

Hon. Samuel Duwar Deng, MP representing Warrap State at the national parliament said that an action plan need to be taken based on the committee’s report.

“I also support this report to be taken to two committees (Public Account and Finance) so that they can liaise with the Ministry of Finance and Planning and work out some of these recommendations,” he suggested.

Several MPs highlighted the need for greater transparency in the government’s borrowing practices.

They criticized the lack of public information regarding the amount of debt incurred and the specific purposes for which the funds were used.

Hon. Juol Nhomngek an MP representing Lakes State at the TNLA expressed worry that they even don’t know how much the government have borrowed.

“Up to now, we are not clear on the total debts that we have borrowed. How much money we have borrowed from other countries” he stated. “Since we came into this house in 2021 up to now we have never received any presentation dealing with issues to do with any approval of debts.”

Some lawmakers suggested that all loans should be approved by the parliament to increase accountability.

Bocha Martin Enoka, an MP representing Western Equatoria State noted that in the world any debt was supposed to be brought to the parliament.

“Why did they (the executive) bring it to the parliament for details scrutiny; like we have seen here the policy, the framework, the priorities, how do we prioritize our debts” Enoka asked.

Concerns were also raised about the government’s spending priorities. MPs argued that borrowed funds should be invested in productive sectors, such as infrastructure and education, rather than being used for consumption.

David Nailo Mayo a lawmaker representing Eastern Equatoria State hinted that debt is a normal financing means in any budget that needs to be handled with clarity.

“The only thing you go wrong is when you borrow too much and you are not transparent. In our case here not all the loans we borrowed were brought to this assembly” he echoed.

Legislators warned that failure to do so could lead to a debt trap that would burden future generations of South Sudan.

MP Gabriel Guot Guot representing Northern Bahr el Ghazal State stressed that debt management is a very important issue saying the recommendations made by the committee of public accounts are very essential.

Guot Guot urged the Public Accounts Committee to do their oversight role by cross checking and whether there is department for debts management in the ministry of finance to ensure there is one.

“They (committee) have to say that initiate and establish this department in order to help us because debt is money that was there and if it is not managed well it will become a crisis and a risk to the country” he lamented.

The MPs’ concerns come amid growing fears that South Sudan’s debt burden could become unsustainable. With limited revenue streams and a fragile economy, the country faces a significant risk of debt distress.

Parliamentarians have urged the government to take immediate steps to address the debt crisis, including implementing the recommendations outlined in the Public Account Committee’s report which was adopted by the House.

It however remains to be seen whether the executive arm of government will heed these calls and take decisive action to safeguard South Sudan’s financial future.