By Staff Writer

South Sudan National Revenue Authority (SSNRA) has announced a record collection of 132.6 billion South Sudanese Pounds (SSP) in non-oil revenue for March 2025.

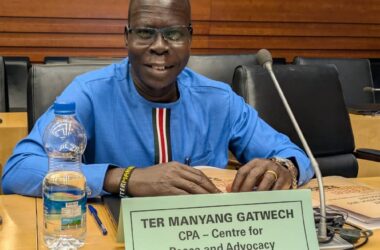

Commissioner General of SSRA, Simon Akuei Deng revealed the significant achievement during the opening of the five-day East African Revenue Authorities Technical Committee meeting in Juba on Monday.

He clarified that recent media reports stating a collection of 36 billion SSP were inaccurate, explaining that the 36 billion figure represented only the revenue generated from the Nimule border post.

“I also want to thank and congratulate my colleagues from the domestic and customs [departments] and the headquarters, in March 2024, the South Sudan Revenue Authority reported a gross revenue collection of SSP 132.6 billion,” Akuei stated.

He clarified that for the last few days, the social media had misreported that the SSRA have collected only 36 billion for the month of March.

“Actually, 36 billion was only from the Nimule border post” Akuei explained “We had set a target of 30 billion in Nimule, but we managed to get 36 billion in March. Put together with the domestic taxes led by Commissioner Chol Kur, we reported a gross of 132.6 billion SSP. I want to repeat this because people are misrepresenting us on social media.”

The SSRA Commissioner General emphasized the landmark nature of this achievement, stating, “This is something that needs to be recorded, and it is a record that has never been done here in the Republic of South Sudan.”

The March collection marks a substantial increase compared to the 17 billion SSP collected in January and the 34 billion SSP collected in February 2024.

The Revenue Authority chief attributed the increase in non-oil revenue collections to improved tax compliance, enhanced border monitoring, and stricter enforcement of customs regulations.

However, Akuei also expressed concern over the rising issue of smuggling along the border with Uganda, which poses a challenge to the authority’s revenue collection efforts.

The SSNRA is expected to address these challenges with the continued implementation of improved tax strategies.