By Yiep Joseph

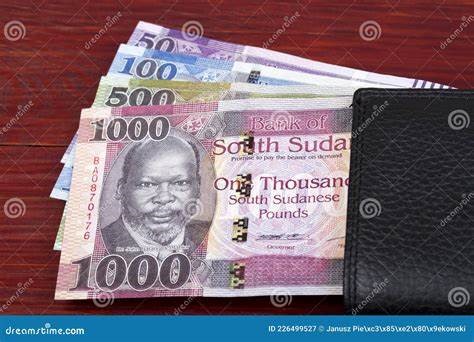

As South Sudan struggles with a cash shortage, an economist has urged the Minister of Finance and Planning to implement six strategies to address the situation.

In a letter to Dr. Marial Dongrin Ater, the Minister of Finance and Planning, Baak Chan Yak Deng (MAF) called for immediate solutions to the cash crisis impacting the country, especially given the monthly release of salaries without sufficient funds to pay government employees.

Mr. Chan emphasized that effective measures to tackle this crisis would depend on the specific context of shortage.

To effectively resolve the ongoing cash crisis, he said, the Ministry of Finance and Planning should enhance liquidity management.

This involves increasing the cash supply through coordinated efforts between commercial banks and the central bank, as well as optimizing cash reserves to ensure timely replenishment of ATMs and branches.

The economist added that the government should improve cash flow planning. This, he said, includes conducting comprehensive forecasting to anticipate cash demand and prevent shortages and authorities should also encourage banks to adopt real-time monitoring systems for cash flow management.

Further, the economist highlighted the need to strengthen banking infrastructure by investing in modern cash handling and transportation systems, which would increase efficiency. Expanding digital financial services could also help reduce reliance on physical cash.

Other recommended steps to address the cash shortage include implementing policies that incentivize cashless transactions.

This, according to the economist, would alleviate pressure on physical cash reserves and facilitate easier access to digital banking and mobile payment platforms.

Collaboration with the private sector remains essential in resolving the cash shortage.

“Implementing these measures will help stabilize cash availability, improve the resilience of the financial system, and foster confidence among the public and stakeholders,” the economist stated.

He also stressed the necessity for the Ministry of Finance and Planning to intensify efforts to tackle the cash shortage, noting, “without knowing the specific details of the reported shortage, it’s impossible to provide a perfectly tailored solution.”

In a separate statement, economist Abraham Maliet urged the public to deposit their money in banks in response to the cash shortage, highlighting that the issue is exacerbated by individuals hoarding large amounts of cash at home.

Recently, Dr. Marial Dongrin Ater remarked that the shortage of South Sudanese pounds has crippled the economy, plunging the government into uncertainty.

The economy has been under pressure for years, with crude oil export revenues dwindling since 2013.

The economic outlook has worsened due to disruptions in crude oil exports via Port Sudan amid the ongoing civil war in neighboring Sudan, which erupted on April 14, 2023.

The South Sudanese pound (SSP) has continued to lose value against the U.S. dollar, resulting in high inflation in the market.

During the swearing-in of the new Central Bank Governor in Juba, Dr. Marial noted that the government is unable to pay civil servants due to the cash shortage.

“The major challenge you will face is how to address the cash shortage in the economy,” he stated, emphasizing that the crisis has affected government service delivery and salary payments.

“We have managed to pay salaries for the past seven months without fail, but that money goes into accounts without cash. So, obtaining cash is the biggest problem,” he explained.

He disclosed that the ministry has implemented policies aimed at boosting economic recovery. “We have policies in place and have been working to ensure full recovery as soon as possible.”

For his part, Dr. Addis Abab Othow, the newly appointed governor of the Central Bank, vowed to ensure timely payment of salaries.

“I am committed to working closely with the minister and all stakeholders to streamline our efforts and ensure that salaries are paid on time,” Othow stated.